3. Example resources from Workride (1-Page Employee Education Template)

Communication Workride with you team

A key part of ensuring your staff are informed when they decide to use Workride is being informed about what it is, how it works, and some key points to consider.

Workride help you with this with some examples below, aswell as a key points that you can use on you 'employee education 1-pager' that you might consider giving to each participating staff. Here are some key strategies:

- Announce via Communication:

Use your internal communication platform or send out an email to introduce Workride to your staff. - Provide Clarity with a Video:

Include a link to our explainer video so everyone can easily understand what Workride offers. - link here - Understanding Workride's Savings Estimator:

- Estimate your savings:

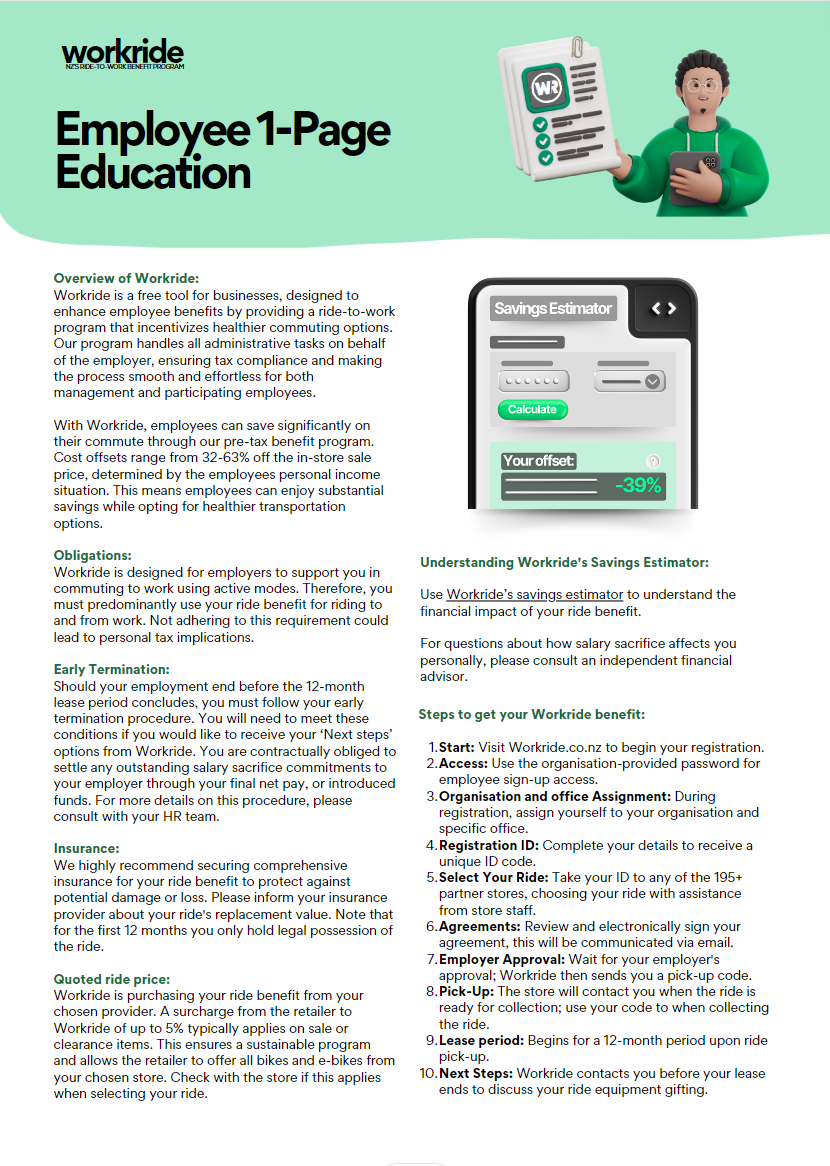

Use Workride’s savings estimator to see the financial impact of your ride benefit. For questions about how salary sacrifice affects you personally, please consult an independent financial advisor. Link to savings estimator - Quoted ride price:

Workride is purchasing your ride benefit from your chosen provider. A surcharge from the retailer of up to five percent typically applies on sale or clearance items, ensuring a sustainable program and a broad selection of bikes and e-bikes. Check with the store if this applies when selecting your ride.

Employee Education 1 Pager

Consider developing a concise '1-pager' for all participating employees to inform them about the critical details on Workride.

This document could include essential information about the program and might require employees to acknowledge they've read and understood it. Workride provides a template for this 1-pager, showcasing content commonly used by other employers. This resource helps you address frequent questions upfront and detail any specific internal processes your organization may have.

Our team can provide you with a template like that below:

Our team can provide you with a template like that below:

An example of what can be contained in a 1-pager employee education document:

Overview of Workride: Employees temporarily reduce their pre-tax salary (salary sacrifice) in exchange for a bike, e-bike, or scooter benefit of their choice for commuting to and from work. Through the Workride process, employees feel a cost offset between 32-63% off, which is made possible through tax benefits.

Obligations: Workride is designed for employers to support you in commuting to work using active modes. Therefore, you must predominantly use your ride benefit for riding to and from work. Not adhering to this requirement could lead to personal tax implications.

Early Termination: Should your employment end before the 12-month lease period concludes, you must follow your early termination procedure. You will need to meet these conditions if you would like to receive your ‘Next steps’ options from Workride. This typically involves settling any outstanding salary sacrifice commitments to your employer through your final net pay, or introduced funds. For more details on this procedure, please consult with your HR team.

Insurance: We highly recommend securing comprehensive insurance for your ride benefit to protect against potential damage or loss. Please inform your insurance provider about your ride's replacement value. Note that for the first 12 months you only hold legal possession of the ride.

Understanding Workride's Savings Estimator: Estimate your savings: Use Workride’s savings estimator to understand the financial impact of your ride benefit. For questions about how salary sacrifice affects you personally, please consult an independent financial advisor.

Quoted ride price: Workride is purchasing your ride benefit from your chosen provider. Eyeing up a ride on sale or clearance? Expect a retailer surcharge of up to 5% on ride orders, especially for rides priced below the RRP. This ensures our retail partners can sustainably offer a full range of rides in-store.

Steps to get your Workride benefit:

- Start: Visit Workride.co.nz to begin your registration.

- Access: Use the organisation-provided password for employee sign-up access.

- Organisation and office Assignment: During registration, assign yourself to your organisation and specific office.

- Registration ID: Complete your details to receive a unique ID code.

- Select Your Ride: Take your ID to any of the 175+ partner stores, choosing your ride with assistance from store staff.

- Agreements: Review and electronically sign your agreement, this will be communicated via email.

- Employer Approval: Wait for your employer's approval; Workride then sends you a pick-up code.

- Pick-Up: The store will contact you when the ride is ready for collection; use your code to when collecting the ride.

- Lease period: Begins for a 12-month period upon ride pick-up.

- Next Steps: Workride contacts you before your lease ends to discuss your next steps regarding ride equipment gifting.

Acknowledgement: I confirm my understanding and agreement with the terms and responsibilities associated with my participation in the Workride program. I also affirm that I have been provided with adequate information and have had the opportunity to seek clarification and independent advice on any aspects of the program.

Related Articles

1. Workride Overview (Pre-signing, Process Overview, Considerations)

Welcome - Pre-signing Support Welcome to Workride, New Zealand's ride to work benefit program. Workride is excited to support your team in providing a significant benefit for your staff. The 'Pre-signing' resource will work through everything your ...4. Example Employer Internal Processes (HR, Payroll, Accounts, Employee)

Implementing our process into your organization is straightforward, and the Workride team is here to support you every step of the way, ensuring maximum success. We work with your HR and Payroll teams to set up a clear procedure for managing the ride ...8. Why is Workride the safest option for employers?

Workride delivers the best benefit for employees while safeguarding employers and directors from risks. By externalizing Health & Safety, Consumer Guarantees Act (CGA), and CCCFA obligations to Workride, we ensure full compliance and minimise ...Inland Revenue's Binding Ruling on Workride

Click on this link or the picture below to be redirected to Inland Revenue's binding ruling on Workride.EY's Interpretation of Inland Revenue's binding ruling for Workride

Click on the link or image below to be re-directed to EY's interpretation document of Workride's binding ruling with Inland Revenue. Link to Interpretation Document here